All Categories

Featured

Table of Contents

Any kind of earlier, and you'll be fined a 10% very early withdrawal fee in addition to the income tax owed. A set annuity is basically a contract between you and an insurance provider or annuity supplier. You pay the insurer, via a representative, a costs that grows tax deferred over time by a rate of interest established by the contract.

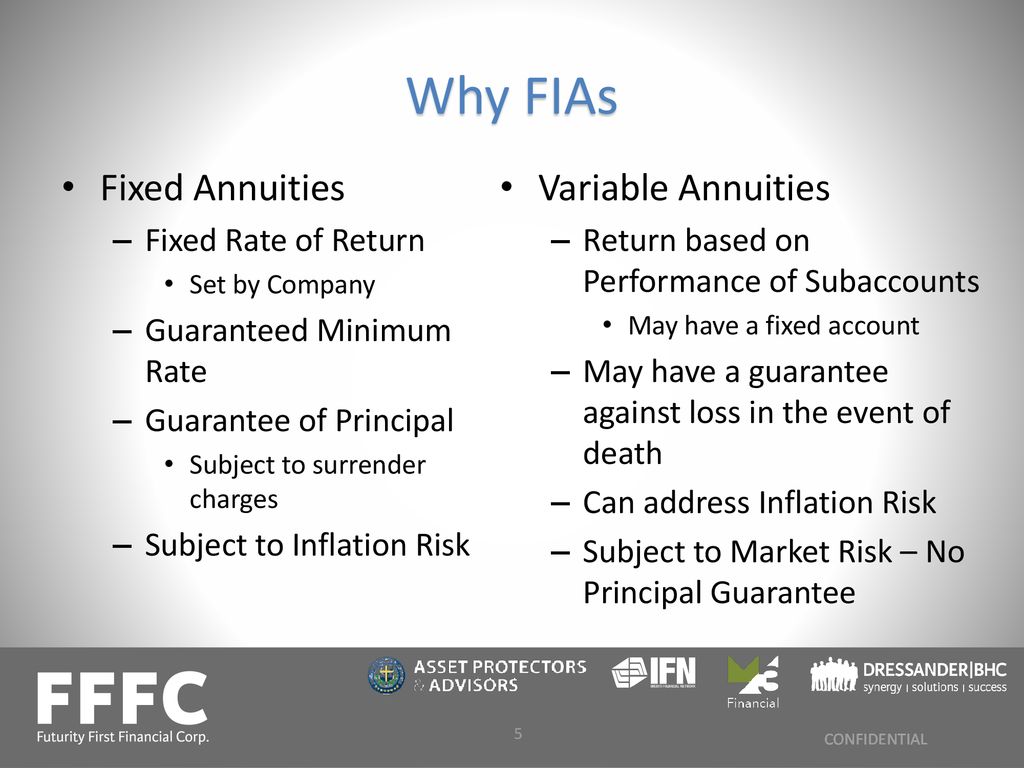

The terms of the contract are all laid out at the beginning, and you can establish up points like a survivor benefit, revenue cyclists, and other various choices. On the other hand, a variable annuity payment will be determined by the efficiency of the financial investment options picked in the agreement.

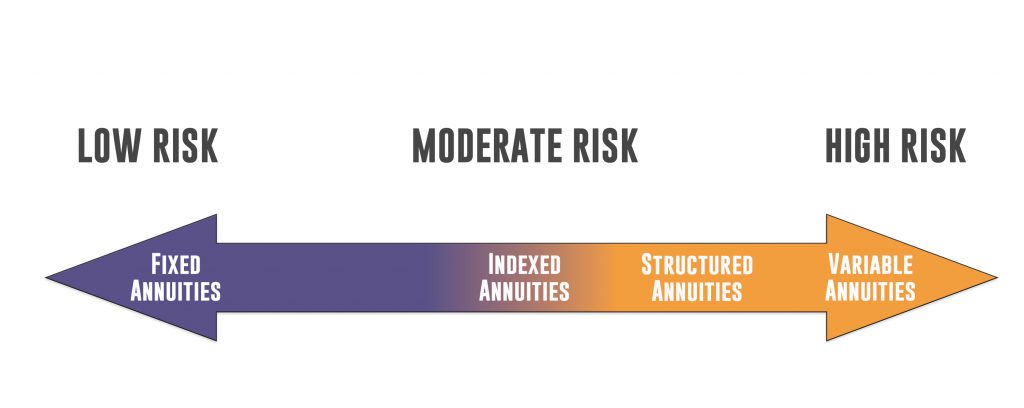

Any guarantees provided are backed by the monetary stamina of the insurer, not an outdoors entity. Capitalists are cautioned to thoroughly assess an indexed annuity for its functions, prices, risks, and how the variables are determined. A set annuity is intended for retirement or various other lasting requirements. It is meant for a person who has enough cash or other fluid possessions for living costs and various other unforeseen emergencies, such as clinical expenditures.

Please think about the investment objectives, dangers, costs, and costs very carefully prior to purchasing Variable Annuities. The program, which has this and other information about the variable annuity agreement and the underlying investment options, can be acquired from the insurance policy firm or your economic specialist. Be sure to check out the program very carefully prior to deciding whether to spend.

Variable annuity sub-accounts vary with changes in market conditions. The principal may deserve a lot more or less than the initial amount spent when the annuity is surrendered.

Analyzing Strategic Retirement Planning Everything You Need to Know About Fixed Vs Variable Annuities Defining Variable Annuities Vs Fixed Annuities Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Can Impact Your Future Fixed Index Annuity Vs Variable Annuities: Explained in Detail Key Differences Between Fixed Index Annuity Vs Variable Annuities Understanding the Rewards of Annuities Fixed Vs Variable Who Should Consider Strategic Financial Planning? Tips for Choosing Indexed Annuity Vs Fixed Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Variable Vs Fixed Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Trying to decide whether an annuity could fit into your monetary strategy? Understanding the various available annuity options can be a valuable means to begin.

In exchange for the initial or continuous premium repayment, the insurance firm dedicates to specific terms set in the agreement. The simplest of these agreements is the insurance company's dedication to giving you with repayments, which can be structured on a monthly, quarterly, semi-annual or annual basis. Additionally, you may select to forego payments and permit the annuity to expand tax-deferred, or leave a round figure to a beneficiary.

There also could be optional features (riders) offered to you, such as a boosted fatality advantage or lasting care. These stipulations commonly have actually included charges and costs. Relying on when they pay, annuities fall into 2 main classifications: immediate and delayed. Immediate annuities can supply you a stream of earnings today.

Breaking Down Immediate Fixed Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Pros and Cons of What Is Variable Annuity Vs Fixed Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning Variable Annuity Vs Fixed Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Annuities Variable Vs Fixed Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Annuity Vs Equity-linked Variable Annuity A Closer Look at How to Build a Retirement Plan

When you can afford to wait for a while to obtain your payout, a deferred annuity may be a great selection for you. Immediate annuities can offer a routine stream of guaranteed payments that can be structured for the remainder of your life. They might also refund any remaining settlements that haven't been made in the occasion of sudden death.

With prompt annuities, there are different kinds of repayment options. For instance, a life payment offers a settlement for your lifetime (and for your partner's life time, if the insurance provider uses an item with this choice). Period particular annuities are simply as their name suggests a payment for a set amount of years (e.g., 10 or two decades).

Additionally, there's in some cases a refund choice, a function that will certainly pay your recipients any kind of remaining that hasn't been paid from the preliminary premium. Immediate annuities generally offer the greatest settlements contrasted to other annuities and can aid attend to an immediate revenue demand. There's constantly the chance they may not keep up with rising cost of living, or that the annuity's beneficiary might not get the continuing to be balance if the owner chooses the life payment choice and then passes away prematurely.

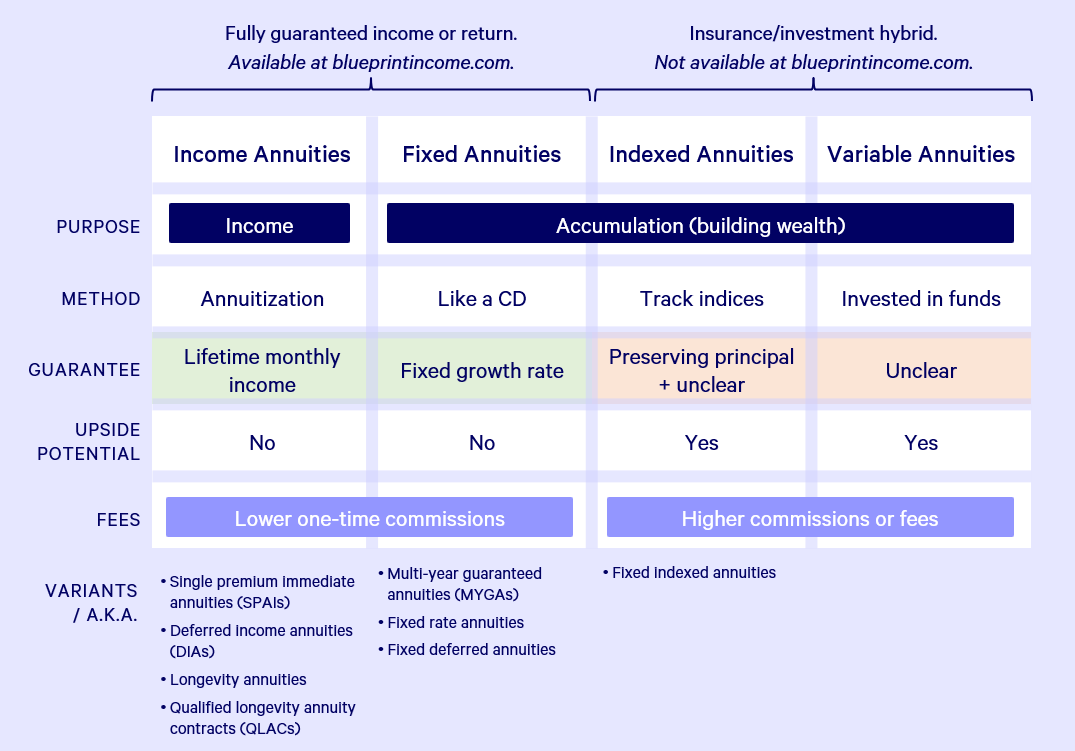

Taken care of, variable and set indexed annuities all accumulate passion in different means. All three of these annuity types generally offer withdrawals, methodical withdrawals and/or can be established up with an ensured stream of revenue. Perhaps the easiest to recognize, repaired annuities aid you expand your cash since they provide a fixed passion rate (guaranteed price of return) over a set duration of years.

Analyzing Strategic Retirement Planning Key Insights on What Is Variable Annuity Vs Fixed Annuity Defining Fixed Vs Variable Annuity Pros And Cons Features of Variable Annuity Vs Fixed Indexed Annuity Why Annuities Fixed Vs Variable Can Impact Your Future How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing What Is Variable Annuity Vs Fixed Annuity FAQs About Fixed Vs Variable Annuity Pros Cons Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Annuity Fixed Vs Variable A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Interest made is intensified and can be left in the annuity to remain to expand or can be taken out after the agreement is annuitized (or possibly throughout the agreement, depending upon the insurance provider). Once the dealt with annuity agreement is started, the insurance policy company can not customize its rate of interest. The interest rates offered might not maintain up with inflation, and you are dedicated to them for the collection duration regardless of economic changes.

Depending upon the performance of the annuity's subaccount options, you may receive a higher payout as an outcome of that market direct exposure; that's because you're additionally running the risk of the added balance, so there's likewise an opportunity of loss. With a variable annuity, you get every one of the passion credited from the spent subaccount.

And also, they may likewise pay a minimal surefire rates of interest, despite what takes place in the index. Payouts for repaired indexed annuities can be structured as guaranteed periodic settlements just like various other sort of annuities, and passion depends upon the regards to your contract and the index to which the money is linked.

Just dealt with indexed annuities have a move day, which marks the day when you first begin to take part in the index allowance's efficiency. The sweep day differs by insurance firm, but usually insurance firms will certainly allot the funds between one and 22 days after the first financial investment. With taken care of indexed annuities, the crediting period begins on the sweep date and commonly lasts from one to 3 years, relying on what you select.

For younger individuals, a benefit of annuities is that they provide a method to start preparing for retired life early on. With an understanding of how annuities work, you'll be much better geared up to choose the ideal annuity for your requirements and you'll have a far better understanding of what you can likely expect in the process.

A fixed annuity is a tax-advantaged retired life cost savings option that can assist to assist develop foreseeable properties while you're functioning. After you make a decision to retire, it can create an ensured stream of earnings that might last for the remainder of your life. If those benefits attract you, check out on to locate out even more concerning: How set annuities workBenefits and drawbacksHow fixed annuities contrast to various other kinds of annuities A fixed annuity is a contract with an insurance business that is comparable in lots of methods to a bank certificate of deposit.

Understanding Financial Strategies A Closer Look at Fixed Vs Variable Annuity Pros Cons Breaking Down the Basics of Investment Plans Benefits of Fixed Vs Variable Annuity Pros And Cons Why Variable Annuity Vs Fixed Annuity Is Worth Considering How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Risks of Variable Vs Fixed Annuities Who Should Consider Fixed Annuity Vs Equity-linked Variable Annuity? Tips for Choosing Fixed Index Annuity Vs Variable Annuities FAQs About Annuities Fixed Vs Variable Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Indexed Annuity Vs Market-variable Annuity A Beginner’s Guide to Retirement Income Fixed Vs Variable Annuity A Closer Look at Fixed Annuity Vs Variable Annuity

Commonly, the rate of return is assured for several years, such as five years. After the initial surefire period, the insurer will reset the rate of interest price at normal intervals usually each year but the brand-new rate can not be reduced than the ensured minimum passion rate in the agreement.

You do not always have to convert a dealt with annuity right into normal revenue repayments in retirement. Most of the times, you can select not to annuitize and receive the whole value of the annuity in one lump-sum settlement. Dealt with annuity contracts and terms vary by company, yet other payout choices usually consist of: Duration specific: You receive normal (e.g., monthly or quarterly) assured repayments for a set time period, such as 10 or two decades.

Decoding Fixed Annuity Vs Equity-linked Variable Annuity Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity What Is Fixed Interest Annuity Vs Variable Investment Annuity? Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Annuities Fixed Vs Variable Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Annuities Variable Vs Fixed

This may give a tax obligation benefit, especially if you start to make withdrawals when you're in a reduced tax bracket. Compounded development: All rate of interest that continues to be in the annuity additionally gains interest. This is called "compound" interest. This development can continue for as long as you hold your annuity (topic to age limits). Surefire earnings: After the very first year, you can transform the quantity in the annuity right into a guaranteed stream of set earnings for a specific duration of time and even for the remainder of your life if you select.

Latest Posts

Axa Variable Annuity

Secondary Market Annuities

Annuities In Estate Planning